Affordable Website Options For Startups With Payment Systems

Affordable Website Options For Startups With Payment Systems - Economical Platforms for Getting Started Online

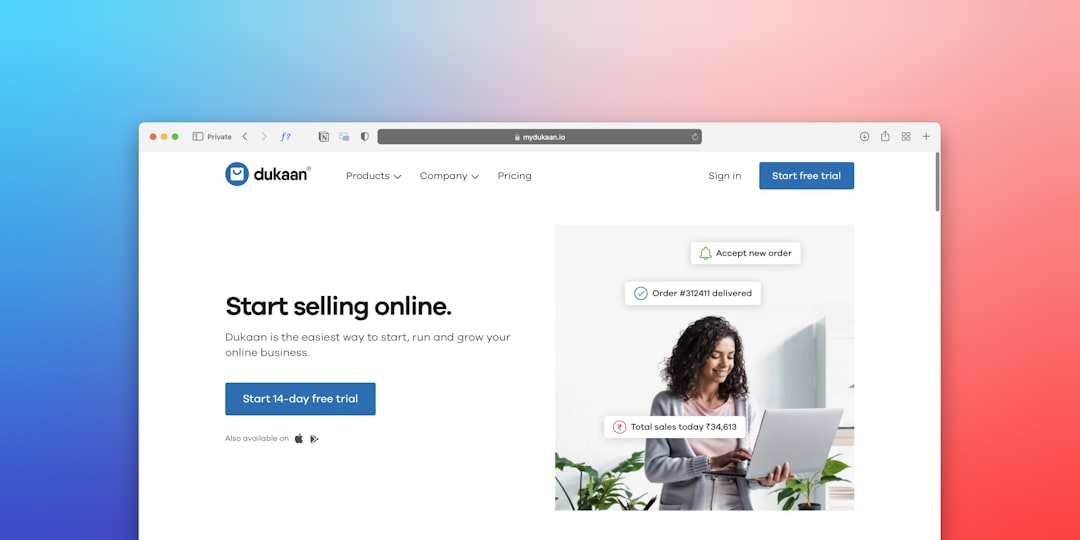

For startups aiming to establish an online presence without significant upfront investment, a variety of digital platforms offer cost-effective starting points. These typically range from user-friendly website builders designed for quick setup to more specialized e-commerce platforms equipped with robust selling features. While ease of use and template customization are common aspects, differentiating factors often lie in the depth of integrated tools, particularly concerning payment processing options, inventory management, customer relationship features, and scalability for growth or international sales. Some platforms emphasize simplicity and speed, potentially incorporating newer AI-assisted design tools, while others provide more comprehensive back-end capabilities better suited for managing larger product catalogs or complex sales workflows. Free tiers can be appealing initially, but assessing their limitations on features, customization, or transaction fees against paid plans is crucial for long-term viability. The effective choice ultimately depends on a careful alignment of the startup's specific operational requirements and desired payment functionalities with the platform's actual capabilities, rather than just the initial price tag.

Investigating the underlying mechanisms enabling cost-effective online platform access reveals several interesting facets.

For instance, many lower-cost platforms achieve their pricing largely through highly optimized and often multi-tenant cloud infrastructure. By pooling resources and employing architectural patterns like containerization, they can efficiently serve a vast number of users simultaneously. This operational efficiency translates directly into reduced infrastructure costs per user, which forms a basis for more accessible pricing tiers, all while maintaining a baseline of technical performance adequate for initial operations.

Furthermore, platform performance, even on economical plans, appears to be a significant consideration driven by observed user behavior. Analysis consistently shows that site loading times, measured in mere seconds, can have a non-trivial impact on visitor engagement and whether they complete desired actions, such as initiating a transaction. The engineering effort invested in optimizing delivery pipelines, caching, and content handling on these platforms, despite their shared nature, seems to be a direct response to this observed market reality, aiming to provide a functional advantage even at entry level.

The feature sets offered by many economical platforms are not simply arbitrary collections; they often appear to be curated based on extensive data analysis. By examining the usage patterns across millions of deployed sites, platform developers can identify and prioritize the functionalities most commonly required by startups or small businesses. This data-informed approach allows for the efficient bundling of statistically relevant features, avoiding the development and maintenance overhead of less-used tools, thereby streamlining the platform and helping keep costs manageable.

An unexpected aspect of the standardized environment common to these platforms can be its contribution to security posture against widespread threats. While uniformity can present a single point of failure for certain novel exploits, the platform provider's ability to push critical security patches and updates across the entire user base simultaneously offers a form of collective protection. This rapid and broad deployment mechanism for addressing common vulnerabilities often exceeds the capacity of an individual startup managing a more unique or custom technical stack.

Finally, the seamless integration with established global payment processing systems via documented APIs is a critical technical shortcut provided by these platforms. This eliminates the immense technical and regulatory complexity a startup would face in trying to build or directly manage secure financial transaction infrastructure itself. The platforms essentially abstract away the burden of navigating intricate payment network requirements and compliance standards, leveraging existing robust systems built and maintained by specialized financial technology providers.

Affordable Website Options For Startups With Payment Systems - Integrating Essential Payment Capabilities

Getting payments working smoothly is foundational for any online startup aiming to exchange goods or services for money. At its core, this involves integrating with a payment gateway – essentially a service that handles the secure transmission of transaction data between the customer, your business, and the banks. Choosing which gateway to use isn't a trivial matter; startups need to weigh potential transaction costs, how straightforward the technical setup is, and whether it fits their particular business model, like recurring subscriptions versus one-off purchases. While many options exist claiming simplicity, the actual process can sometimes require navigating varied technical documentation depending on the chosen platform and gateway combination. Getting this part right isn't just about accepting cards; it's about building a reliable channel that can manage transactions efficiently as the business grows.

Delving into the operational mechanics of integrating payment processing into online platforms reveals several intriguing aspects often overlooked.

For instance, contrary to the simplicity often portrayed, the flow from a user clicking 'pay' to a transaction being confirmed is a sophisticated technical ballet. It requires coordination between numerous entities – the customer's browser, the website platform, the payment gateway, the acquiring bank (merchant's bank), the card network (Visa, Mastercard, etc.), and the issuing bank (customer's bank) – often involving rapid, sequential technical 'handshakes' all completed within seconds.

The seemingly straightforward input fields on a payment form are under surprisingly intense scrutiny. Research indicates that the specific layout, terminology, and progression of steps in the checkout interface are not merely aesthetic choices but demonstrably impact user psychology, trust levels, and ultimately, the likelihood of a completed sale. This suggests that the front-end design is a critical engineering interface to the backend financial pipeline.

Modern systems managing these transactions heavily rely on computational intelligence. Sophisticated machine learning models analyze a multitude of behavioral and transactional data points in real-time for each request, attempting to identify and flag potentially fraudulent activity before authorization. While impressive in scale and speed, no automated system is entirely perfect, and balancing fraud prevention with minimizing false positives (legitimate transactions incorrectly declined) remains an ongoing engineering challenge.

Achieving the apparent 'instantaneous' nature of online payments hinges on extremely low network latency and high system reliability across geographically dispersed financial infrastructures. The complex sequence of validations, authorizations, and confirmations must execute consistently and quickly, demanding robust networking protocols and error handling mechanisms to avoid frustrating delays or transaction failures.

Furthermore, enabling truly global sales on a platform necessitates integrating a diverse and evolving landscape of payment methods far beyond just major international credit cards. Supporting regional preferences like specific bank transfer systems, local digital wallets, or country-specific installment payment providers adds layers of technical complexity and requires adherence to varied, often localized, technical specifications and regulatory requirements.

Affordable Website Options For Startups With Payment Systems - Selecting Tools Relevant for Fundraising Tech

Choosing the appropriate technology for managing fundraising efforts stands as a significant hurdle for emerging organizations seeking support. The current environment presents a multitude of digital aids, encompassing broad platforms designed for campaigns as well as more specific software suites focused on supporter engagement or processing contributions. Each tool purports to offer unique advantages, demanding careful appraisal beyond mere feature lists touted by providers. Making certain these chosen tools function seamlessly together, especially regarding the technical aspects of handling finances, often requires more effort and technical inspection than initial impressions might suggest. Observing the trajectory towards mid-2025, while tools increasingly promise deeper integration and smarter features, scrutinizing their practical effectiveness in boosting efficiency and genuinely cultivating connections with those willing to help remains crucial. Ultimately, the tangible impact these digital utilities have on simplifying the complex process of reaching out and securing necessary funding dictates their true value.

Empirical evidence from platform usage suggests a surprising correlation: removing just a single non-essential field from a donation form often translates into a statistically measurable uptick in completed transactions. This observation points to a significant, almost counter-intuitive, sensitivity in user interaction pipelines, where minimalist interfaces aren't merely aesthetically pleasing but appear empirically more effective in channeling desired donor behavior.

A closer look at the underlying architecture of many lower-cost platforms reveals built-in data structures specifically engineered to capture key metrics relevant to fundraising. Mechanisms like automated tagging based on unique ingress points (e.g., campaign-specific URLs) allow for direct, granular tracking of donor origins. This integrated data capture provides a foundational layer for analyzing the efficacy of different outreach efforts, serving a critical analytical need often before a startup can invest in more complex dedicated donor management software.

The seemingly routine function of auto-generating tax receipts, a basic expectation, is technically non-trivial. It necessitates backend systems equipped with complex, frequently updated engines capable of interpreting and applying disparate tax regulations across various jurisdictions, factoring in variables like donation type and the donor's geographical location. This hidden layer of regulatory compliance logic represents a significant engineering burden the platform shoulders, abstracted away from the user, yet crucial for lawful operation.

Implementing reliable scheduled giving involves sophisticated backend machinery. This infrastructure commonly utilizes dynamic payment tokens – pointers to stored payment details rather than the details themselves for security – coupled with automated processes to manage the lifecycle of these payment methods, handling expirations or required updates. Such systems are critical for minimizing passive churn and the operational overhead previously associated with manually managing subscriptions or repeat donations, indicating a notable investment in automated financial plumbing.

Platforms providing integrated experimentation frameworks, commonly known as A/B testing, offer a quantitative lens on constituent engagement. By systematically presenting variations of content – such as different phrasing in donation appeals or alternative imagery on landing pages – and measuring resultant behavior (e.g., conversion rate, average gift size), these tools allow users to empirically optimize their outreach based on observed donor response, demonstrating the direct applicability of controlled experimentation to fundraising strategy.

Affordable Website Options For Startups With Payment Systems - Planning for Future Growth and Platform Costs

Navigating the path from initial online presence to sustainable expansion requires deliberate consideration of how platform expenses will evolve alongside growth. It's not enough for a starter website solution to simply be inexpensive upfront; its ability to accommodate increasing complexity and user volume without becoming prohibitively costly is paramount. Startups need to look critically at pricing tiers that seem attractive early on but may conceal significant jumps in cost or feature restrictions as the business scales or demands more sophisticated capabilities, such as integrating diverse payment types or managing larger transaction volumes. Realistic financial planning means anticipating these potential escalations, including the less obvious costs tied to maintaining operational efficiency, necessary security updates, and ensuring compatibility with external services over time. Opting for platforms architected with clear, manageable scaling pathways can mitigate future disruptions and unexpected budget hits, allowing the business to integrate enhanced functionalities more smoothly. Ultimately, building a financial strategy that aligns platform expenditure directly with growth projections is key to establishing a resilient digital foundation.

As transaction and supporter data accumulates significantly, the actual computational effort required just to process and derive meaningful insights from this growing dataset can impose a surprisingly heavy, often unanticipated, cost, distinct from simple data storage expenses. Numerous capabilities essential for operational scaling or regulatory adherence, such as automated verification processes, frequently rely on external services accessed via APIs, where usage is typically metered per call; these granular costs can aggregate into substantial and variable expenditures proportional to transaction or user volume. Affordable platforms often impose explicit or implicit resource limits; successfully managing high-volume campaigns can necessitate exceeding these defined boundaries, potentially triggering punitive 'burst' charges or requiring abrupt, costly upgrades to significantly higher-priced tiers, introducing non-linear cost jumps. Attempting to transition historical data, especially in large volumes, off an initially budget-friendly platform to a different or custom-built system at a later stage can be markedly more complex and expensive than the original onboarding. This difficulty is frequently attributed to platform-specific data export constraints or non-standard internal data structures, creating technical interoperability barriers. Beyond a certain operational threshold, the accumulated expenditure on subscription fees for accessing a platform's suite of advanced features can, from a purely technical perspective, begin to exceed a reasonable estimation of the cost to develop and maintain equivalent core functionality internally, suggesting a potential long-term inefficiency in the 'pay-as-you-grow' model.

More Posts from aifundraiser.tech:

- →Strategic Goal Setting: Driving Sales Cofounder Fundraising Results

- →Examining Stakeholder Perspectives on Funding Success Factors

- →ESOP Liquidity Events in Private Startups Key Metrics and Transfer Mechanisms for 2025

- →Beyond the Numbers Unlocking Single Lead Potential

- →Navigating the Evolving Startup Funding Ecosystem

- →Maximizing Startup Funding: Crafting the Strategic Investor Mix